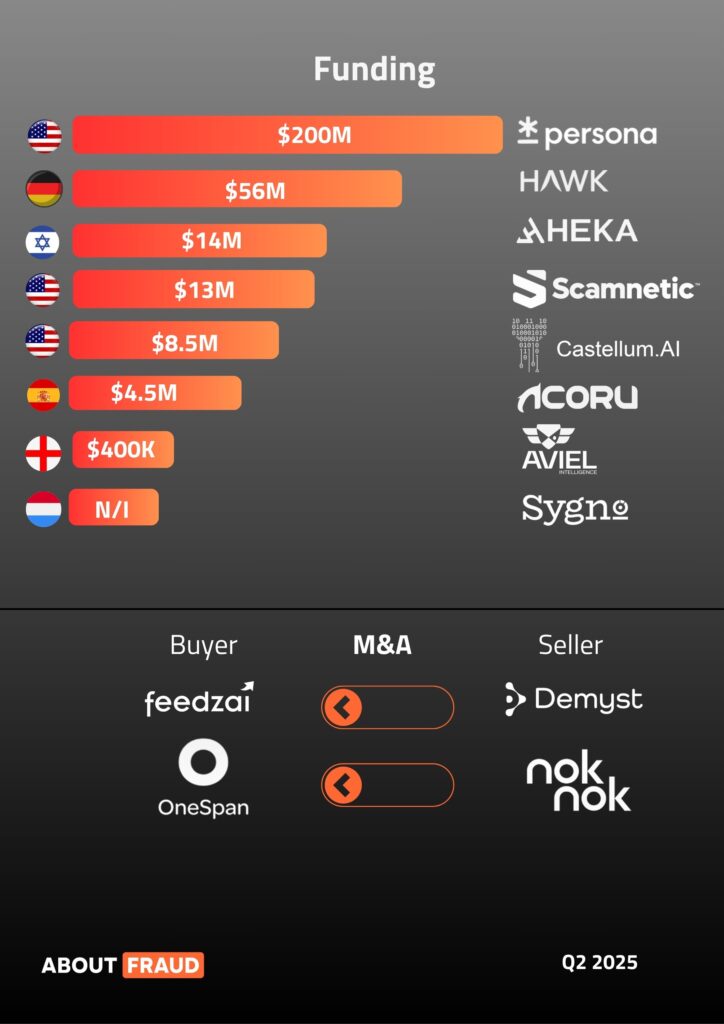

Q2 has wrapped up! It’s time for our quarterly investment update. Explore the latest funding rounds and acquisitions in the world of fraud and risk mitigation!

Funding

Persona

Persona has announced a successful Series D funding round, raising USD 200 million. The round was co-led by Founders Fund and Ribbit Capital, with participation from existing investors including BOND, Coatue, First Round Capital, and Index Ventures.

This funding comes after a period of significant growth for Persona. The company has enhanced its age assurance solutions, expanded its Know Your Business (KYB) capabilities, and scaled its presence in workforce identity security — notably through a partnership with Okta — while also broadening its product suite.

Hawk

Hawk, an AI-driven anti-money laundering (AML), screening, and fraud prevention platform, has raised $56 million in a Series C funding round led by One Peak. The round also saw participation from Macquarie Capital, Rabobank, BlackFin Capital Partners, Sands Capital, DN Capital, Picus, and Coalition, supporting this innovative German regtech company’s growth.

Hawk’s technology enables financial institutions to move beyond traditional rules-based approaches to AML and fraud detection. By leveraging AI, the platform claims to significantly improve accuracy, helping clients identify more illicit activity while reducing false positives.

Heka

Heka, an Israeli startup specializing in web intelligence to fight the rising wave of digital fraud, has raised $14 million in a Series A funding round. The investment will support the company’s expansion into the United States and strengthen its presence across the UK and Europe.

The funding round was led by Windare Ventures, with participation from Barclays, Cornèr Banca, and other institutional investors. Heka aims to leverage this capital to enhance its technology and broaden its reach in tackling online fraud on a global scale.

Scamnetic

Scamnetic, a company dedicated to safeguarding individuals and businesses from digital threats through advanced AI technology, has announced it received $13 million in Series A funding. The round was led by Roo Capital, with participation from 1st and Main Growth Partners, SaaS Ventures, and Riptide Ventures. This investment brings Scamnetic’s total funding to $16 million.

The company plans to utilize the new capital to accelerate growth through expanded marketing, sales, and customer support initiatives, as well as to advance its product roadmap in response to rising global demand. Customers will benefit from an enhanced core feature set, improved international coverage, and deeper support throughout their customer journey.

Castellum

Financial crime compliance platform Castellum.AI has announced the successful closing of an $8.5 million Series A funding round led by Curql.

In addition to Curql, the round saw participation from BTech Consortium and Framework Venture Partners. Existing investors—including Spider Capital, Remarkable Ventures, and Cameron Ventures—also contributed to the funding. The new capital will enable Castellum.AI to deepen its integration with financial institutions, offering its secure, explainable AI solutions to support risk data management, AML, and KYC screening.

Acoru

Acoru, a Spain-based cybersecurity startup specializing in fraud and scam prevention solutions, has successfully raised €4 million in a seed funding round.

The round was led by Adara Ventures and Athos Capital.

Adara Ventures, a European venture capital firm founded in 2005 and headquartered in Luxembourg with additional offices in Madrid, Spain, focuses on early-stage investments in deep technology companies. Their investment interests include cybersecurity, applied artificial intelligence (AI), digital infrastructure, hardware components, digital health, and energy transition technologies. Adara Ventures predominantly supports B2B startups at the seed and Series A stages.

Aviel

A new intelligence-led startup, AVIEL Intelligence, has emerged from stealth with a bold mission: to prevent financial scams before they occur. Founded by former Google operators, the ex-UK director of what3words, and leading intelligence experts, AVIEL Intelligence has secured a £350,000 pre-seed funding round led by Fuel Ventures, one of the UK’s prominent early-stage venture capital firms. The round also includes support from Cambridge Angels and a range of other angel investors, many of whom are respected figures in the cybersecurity industry.

Sygno

Sygno, a fintech company specializing in AI-driven solutions for detecting fraud and money laundering, has received new investment from TIN Capital and ROM Utrecht Region, according to Vestbee. While the exact funding amount was not disclosed, TIN Capital typically invests between €1 million and €10 million.

Founded in 2021 by Sjoerd Slot, Sygno develops advanced machine learning models designed to support financial institutions in identifying and preventing financial crime. The new funding will help Sygno expand its capabilities and accelerate growth in the rapidly evolving anti-financial crime space.

Feedzai

Feedzai, the global leader in fraud and financial crime prevention, announced today the acquisition of Demyst, including its Zonic data workflow orchestration platform, intellectual property, and advanced data integration capabilities. This strategic move aligns with Feedzai’s vision to unify data orchestration and risk management into a single, comprehensive platform.

By integrating Demyst’s sophisticated data workflows, Feedzai aims to provide financial institutions with real-time data, analytics, and trusted artificial intelligence — empowering them to make the most informed and accurate risk decisions faster than ever before.

OneSpan

OneSpan Inc. announced the acquisition of Nok Nok Labs, a leading provider of FIDO passwordless software authentication solutions. This strategic move positions OneSpan at the forefront of the industry’s transition to more secure, flexible, and future-proof authentication options.

By integrating Nok Nok’s innovative solutions with its recently launched FIDO2 security keys, OneSpan aims to deliver the most comprehensive and advanced authentication portfolio globally. Whether on-premises or cloud-based, OTP or FIDO, software or hardware — including Digipass, FIDO2 protocols, and Cronto solutions for transaction signing — the combined offering provides customers maximum flexibility to meet their evolving security needs.

Source link