Published:

February 11, 2026

Reading time:

5 minute read

Written by:

Forter Team

Forter’s Agentic Orchestration Suite helps merchants rapidly activate agentic commerce and easily scale as consumers adopt.

Agentic commerce represents a massive opportunity to unlock a new revenue channel that a fast-growing number of consumers are using to discover, browse, and shop autonomously. According to Morgan Stanley, AI agents could reach between $190 billion to $385 billion of U.S. ecommerce spending by 2030, translating to an estimated 10-20% of market share.

However, there’s a catch. Despite its early days, the agentic ecosystem is already fragmented, making it incredibly resource-intensive and complicated for merchants to begin testing and then fully support. The complexity of the ecosystem will only increase: Google’s Universal Commerce Protocol (UCP) and OpenAI’s Agentic Commerce Protocol (ACP) offer two different approaches to agentic commerce, and new agentic platforms and protocols continue to hit the market.

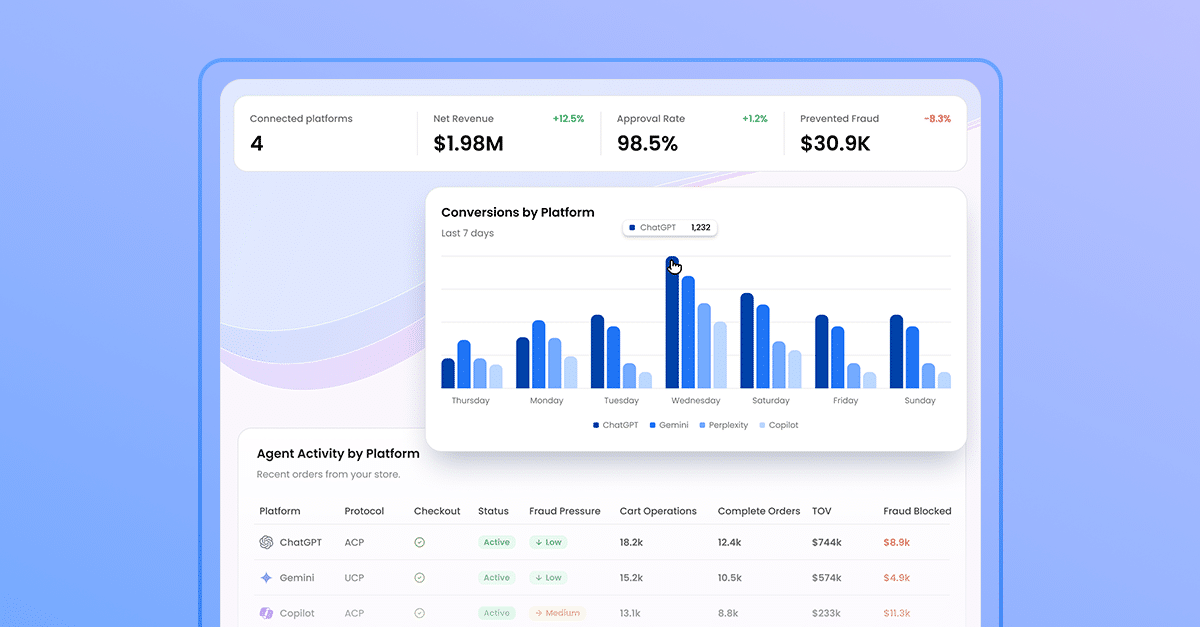

Today, Forter is unlocking the agentic world for its merchants with Agentic Orchestration, a new solution designed to simplify the technical complexity of agentic commerce, allowing merchants to securely accept transactions from any AI agent. With a single integration, merchants can connect agentic protocols to their established retail processes for catalog management, loyalty, fraud and abuse prevention, checkout, payments, refunds and disputes, and customer data management. Forter already serves as the fraud, abuse and payment solution behind many of the world’s leading brands. Agentic Orchestration extends our proven approach to this new agent-led world.

Agentic Orchestration Simplifies the Complexity

Forter’s Agentic Orchestration simplifies the technical complexity required to support agentic commerce. Our orchestration layer handles protocol requirements, payments connectivity, and ecosystem nuances – so that merchants can easily accept transactions initiated by AI agents through a single Forter integration. The solution is designed to align with emerging agentic commerce standards and broader payments ecosystem frameworks that prioritize transparency, verification, and trust without needing merchants to re-architect their existing commerce or payments infrastructure.

What’s more, the solution is agnostic so that merchants can continue to work with any payment processor, agentic platforms or protocols. Its modular design provides merchants with the necessary flexibility to connect product catalogs directly, via existing commerce platform partners or have Forter orchestrate the entire journey. This adaptable offering is enterprise-ready and fits with merchants’ unique tech stack now and in the future.

Key capabilities include:

- Agentic Checkout: Support for the full checkout journey, from cart creation and fulfillment to post-purchase updates

- Product Feed Management: Ingesting merchant feeds to provide AI agents with dynamic updates on stock availability and promotions

- PSP-Agnostic Infrastructure: Enabling agentic transactions across payment processors and payment types, while supporting network-level frameworks

- Embedded Fraud & Risk Management: Delivering real-time, identity-based decisions to approve or decline agentic transactions before they impact your bottom line

A Global Network of Agentic Identities

The ability to connect an agent to a known identity instantly will ultimately determine who succeeds in the agentic era. In this new world, trust is the deciding factor; merchants need to know who they’re really doing business with, even when an AI agent is acting on the shopper’s behalf. Yet agent-initiated transactions often arrive with fewer traditional signals, making it harder for risk teams to assess intent and authenticity without introducing unnecessary friction.

Forter’s identity intelligence closes the agentic trust gap by connecting agent-driven transactions to an underlying consumer identity and evaluating risk in real-time. Powered by a global network of over 2 billion consumers and over half a million businesses, Forter can identify the human shopper behind each agent transaction and evaluate the risk within fractions of a second, even when traditional signals are limited. We then reconcile data across all AI platforms and agentic protocols to unlock a unified customer profile across web, mobile, in-store and agentic so that merchants always know who to trust.

Building the Future of Agentic Commerce

Leading brands across industries, such as luxury, travel and retail, including Mejuri and PacSun, are already working with Forter to prepare their businesses for the future of commerce.

“Every technology leader is exploring testing their way into agentic commerce with both speed and scale,” said Rohit Nathany, Chief Product, Technology, and Marketing Officer at Mejuri. “The space is complex and moving quickly, and most do not yet know which agentic platforms their specific consumers will actually prefer. This makes investing in agentic commerce tough because it requires plugging into so many different systems and retail processes.

“The agentic ecosystem will only continue to evolve and become more complex. Forter’s Agentic Orchestration will let merchants spend their time on what really sets them apart, instead of building and managing integrations. Forter consistently prioritizes both merchants and customers, and their approach to agentic commerce underscores how unique a partner they are for retail and commerce organizations.”

Additionally, Forter is working alongside global technology leaders across payments, agent platforms, and commerce infrastructure to establish trust in the agentic commerce ecosystem. From partnering on emerging protocols like Google’s AP2 to align with network-level frameworks like Mastercard Agent Pay to releasing our Trusted Agentic Commerce Protocol (TACP), we’re collaborating with key partners across payments, ecommerce and technology platforms to ensure that merchants can securely navigate this frontier.

As the agentic commerce ecosystem continues to take shape, payment networks play a critical role in establishing shared foundations for trust, transparency, and secure interoperability.

“Agentic commerce will only scale at the speed of trust. As this ecosystem evolves, ensuring transparency, verification, and secure interoperability becomes even more critical. Mastercard is committed to building that trust layer so every participant in the agent‑driven journey can move with confidence,” said Pablo Fourez, Chief Digital Officer at Mastercard. “As more technology partners like Forter innovate in this space and merchants begin engaging with agentic platforms, our role is to provide the permissioned, transparent foundation they can rely on. That’s why we’ve built Mastercard Agent Pay and the Agent Pay Acceptance Framework to deliver the validation, security, and clarity merchants need to engage with AI agents responsibly—while unlocking the benefits of a new, fast‑growing channel of digital commerce.”

Ready for the Next Era of Commerce?

Our goal is to securely unlock agentic commerce for businesses everywhere. With Forter’s Agentic Orchestration, merchants can support agentic commerce while minimizing upfront and ongoing engineering effort, protecting incremental revenue from fraud, and engaging their most loyal customers via a revolutionary automated shopping experience.

Ready to unlock the full opportunity with agentic commerce? Talk to Forter and read our technical documentation today.

Source link